With the market jumping due to the recent inflation cool-down, many investors are expecting the FED to pivot. But what if it doesn’t happen? Could this potentially lead us to another market crash? Learn options hedge strategies to protect your portfolio against the potential market crash!

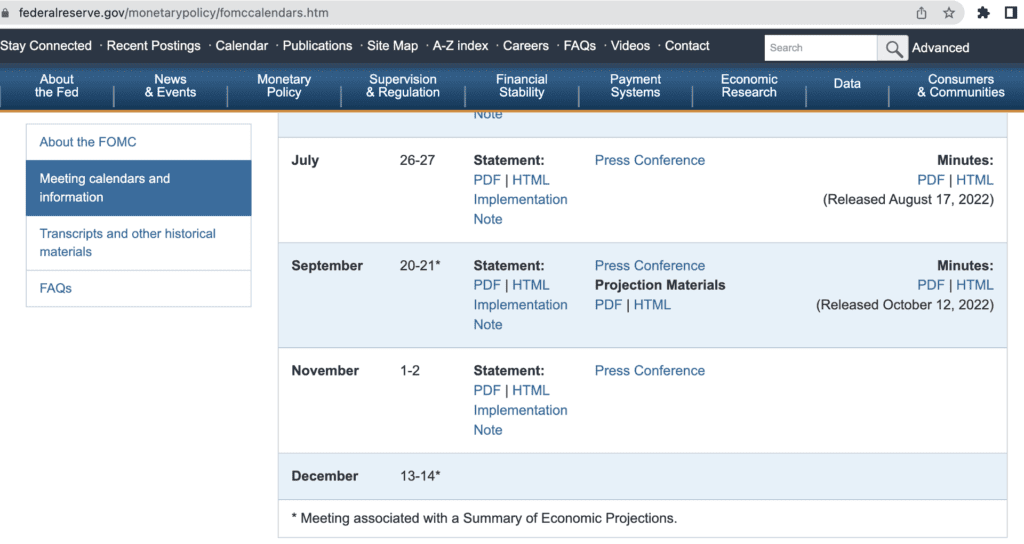

The FED will only be making announcements on their next course of action on 13-14 Dec. So from now till then, nothing can be said for sure.

And in fact, if you see the chart, we are also approaching a strong resistance level. And it’s possible for the market to come down again.

That’s why in this uncertain time if you have a bigger portfolio, you can consider protecting it against the potential drop by using PUT options. And if you want to learn how to use options to hedge against market volatility, then keep on reading!

Options Hedge Strategies – Put Options

In order to potentially protect your portfolio against the drop, you can consider buying PUT options.

By doing so, you get to lock in the selling price for your stocks.

You may be wondering, how does that work?

Think about it as if you are buying health insurance. The reason why we do so is that we want to make sure we are well protected financially when we fall sick. If you really become ill, touch wood, your insurance company will pay you a huge sum of money to help you tie through this difficult period of time.

The same thing can be applied to investing too. And you can buy insurance for your portfolio.

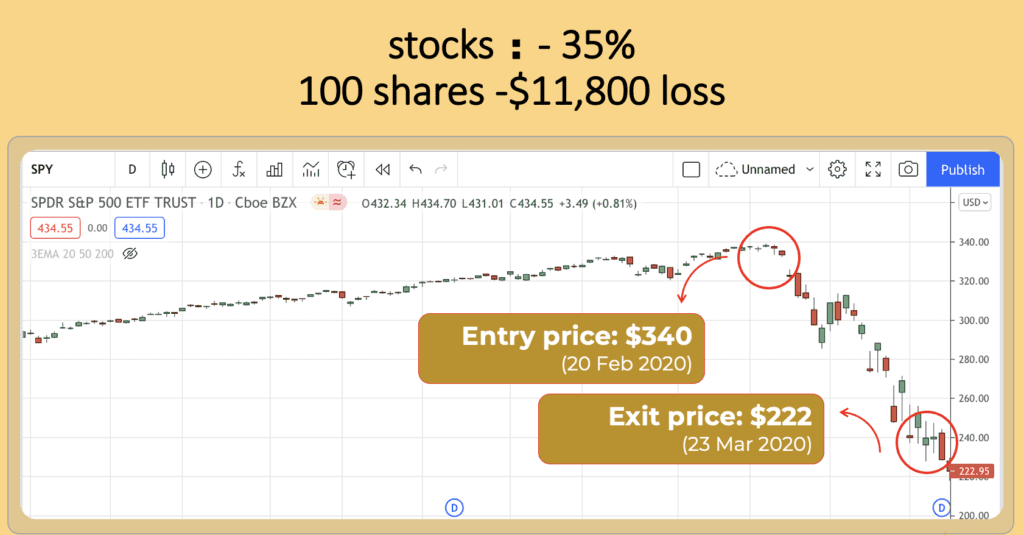

For example, you have 100 shares of SPY, and you are afraid that the market will “fall sick” and drop further from here. That’s why you decide to buy Put insurance at the strike price of $340, and by doing so, you lock in your sell price at $340.

Just as you expected, the market really came down and dropped all the way to $222. While most investors out there are crying for the losses, your portfolio is being protected because you can now choose to sell away your 100 shares of SPY at the lock-in price of $340. So instead of suffering losses, your insurance actually kicks in to give you a handsome sum of money!

How much exactly?

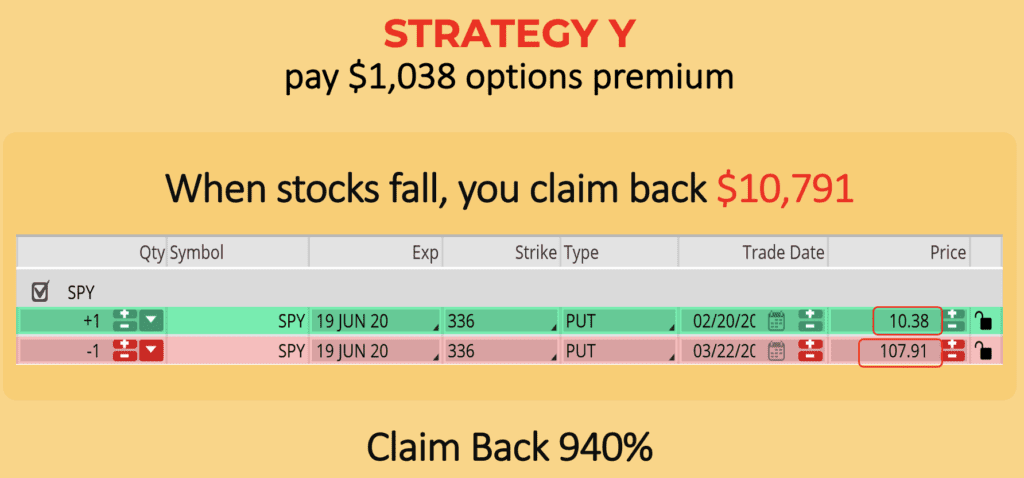

You can see that you initially paid about $1,038 for the put insurance, right now you can claim back $10,791. That’s a whopping 940% gain and protection when the market dropped back in the 2020 covid crash.

Options Hedge Strategies – Step-by-step Guide with MooMoo

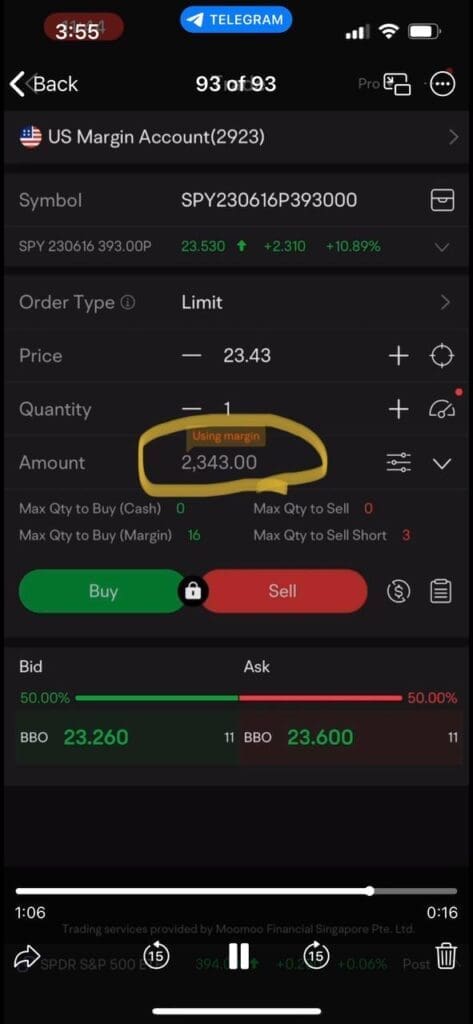

Of course, it’s important to note that we don’t want to overpay our insurance. Because if you do so, you will burn a big hole in your wallet. That’s why right now I am going to log in the moomoo platform to show you how to buy Put insurance at a reasonable price.

Firstly, there are different options dates to choose from. For buying a Put insurance, my advice will be to buy between the duration of 4 months to 6 months, as anything more than that, the insurance premium becomes more expensive.

Choose the strike price that you can lock in to be your sell price, and I will generally choose the price near the current market price, which is $393, so in case it drops further from here, I can still sell my shares at the current market price.

By doing so, you are paying a premium of $2,343.

You can follow the following video step-by-step for the brokerage navigation.

Options Hedge Strategies – What’s Next?

The next thing you do is just wait. And be ZEN…

There’s no point staring at the market every day, hoping that it will drop. After all, the put insurance is for protection purposes, not exactly for you to make a lot of money. It’s the same as you buy health insurance for peace of mind, but deep down you don’t wish to become super ill for the insurance to kick in, correct?

As you can see, options are super powerful. It even allows you to hedge against the current volatility and protect your portfolio!

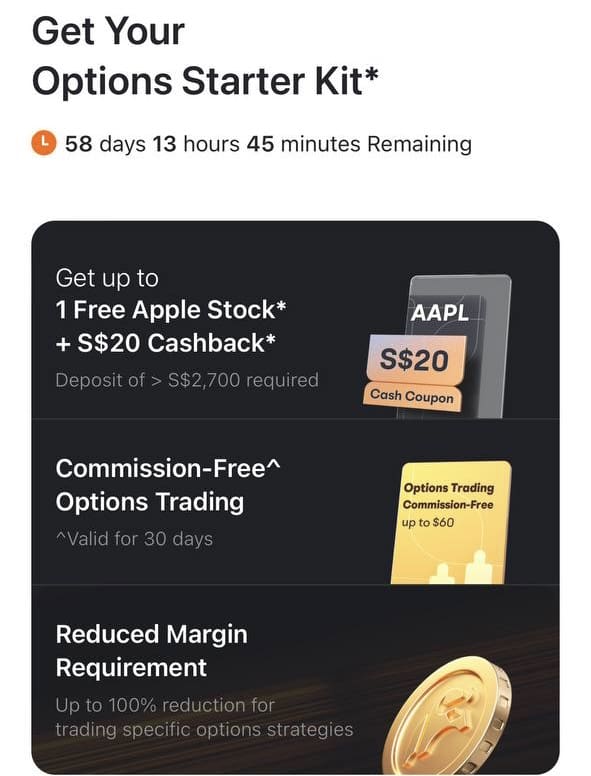

Right now, moomoo even offers 3-month free in-depth options data to my followers and one free “options kit” which includes U.S. stock lifetime free commission, 1-month free commission on options, option learning courses, options paper trading for your options trades. So do register an account and fund $2700 SGD to get a free share including Apple!

If you want to learn more about options, you can also join us in our upcoming Next Level Options Masterclass, a 2-hour free web class where you can learn 3 options strategies to profit in different market conditions!

Do follow my telegram channel to get more investment insights! In the meantime, if you’d love to know how to generate passive income from investing through options, or what options trading strategies work, check out some of the posts on this website to continue learning!