Many of us want to retire as millionaires, so we don’t have to worry about money and still live a comfortable retirement life. The question is, can you retire with a million dollars? And how to amass a million dollars or more by retirement, given the years you have before you retire. If you have read my previous blog posts, you will know that I am a big fan of index investing, especially combining it with the power of options to potentially generate additional passive income.

But you might be thinking, is it really sufficient to help you to retire with millions? The answer is a simple yes — an index fund, such as one that tracks the S&P 500, can be all you need to reach millionaire status.

And the beautiful thing is, you don’t need a lot of money to begin with. All you need is to begin with $5000. Because going from $0 to $1 million is a matter of math. The legendary investor Warren Buffett once said: “If you like spending six to eight hours per week working on investments, do it. If you don’t, then dollar-cost average into index funds”.

Can you retire with a million dollars through index investing?

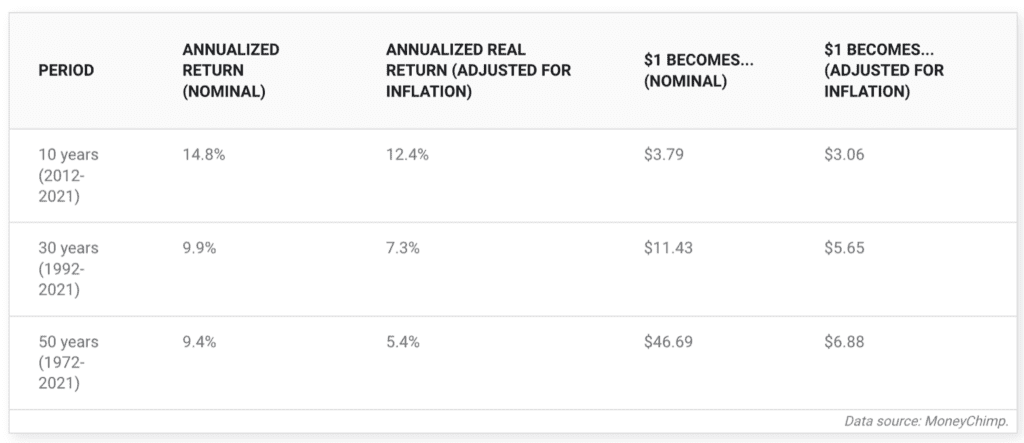

The reason why Buffett said so is because individual companies can rise and fall, if you don’t pick them carefully, your portfolio can suffer. However, if you buy index funds like S&P 500, it’s as if you are buying the 500 largest companies listed on stock exchanges in the United States. So the risk is greatly reduced. And historically, S&P 500 has been giving an average annual return of close to 10% per year over the past 50 years.

And if we adopt the same growth rate of 10% and compound your $5000 from now on, and if you continue to invest an additional $5000 every single year, you will have your $1m retirement portfolio in about 30 years! You can test it out using the calculator.

Of course, at a low average annual growth rate, it can take a long time. But the key is to keep going and make sure you continue to dollar cost average into S&P500 regardless of the market condition every year.

Can you retire with a million dollars with an index and options?

And if you know how to combine it with options, you can potentially make even more returns. In my previous blog post, I shared with you how to make passive income from investing — $600 in 1 single options trade while promising to buy 100 shares of SPY, but in order to execute that trade, you need about $40,000 to get started.

Right after, some of you asked me, what if I don’t have so much money to get started? What if I only have about $5000 only? How can I use options to generate income?

That’s why right now, I am going to introduce you to another index fund, which tracks 300 companies selected from the well-known S&P 500 Index based on three growth factors:

1. Sales growth

2. The ratio of earnings change to price

3. Momentum

And the companies inside this index must have positive reported earnings in the most recent quarters, which means they must be profitable!

As you can see, it has more stringent criteria and focuses more on growth, and this is none other than SPYG. And for the past 10 years, the historical annual return for SPYG is 13.44% as of day or writing, which is more than SPY of 12.33%.

Can you retire with a million dollars by selling options on SPYG?

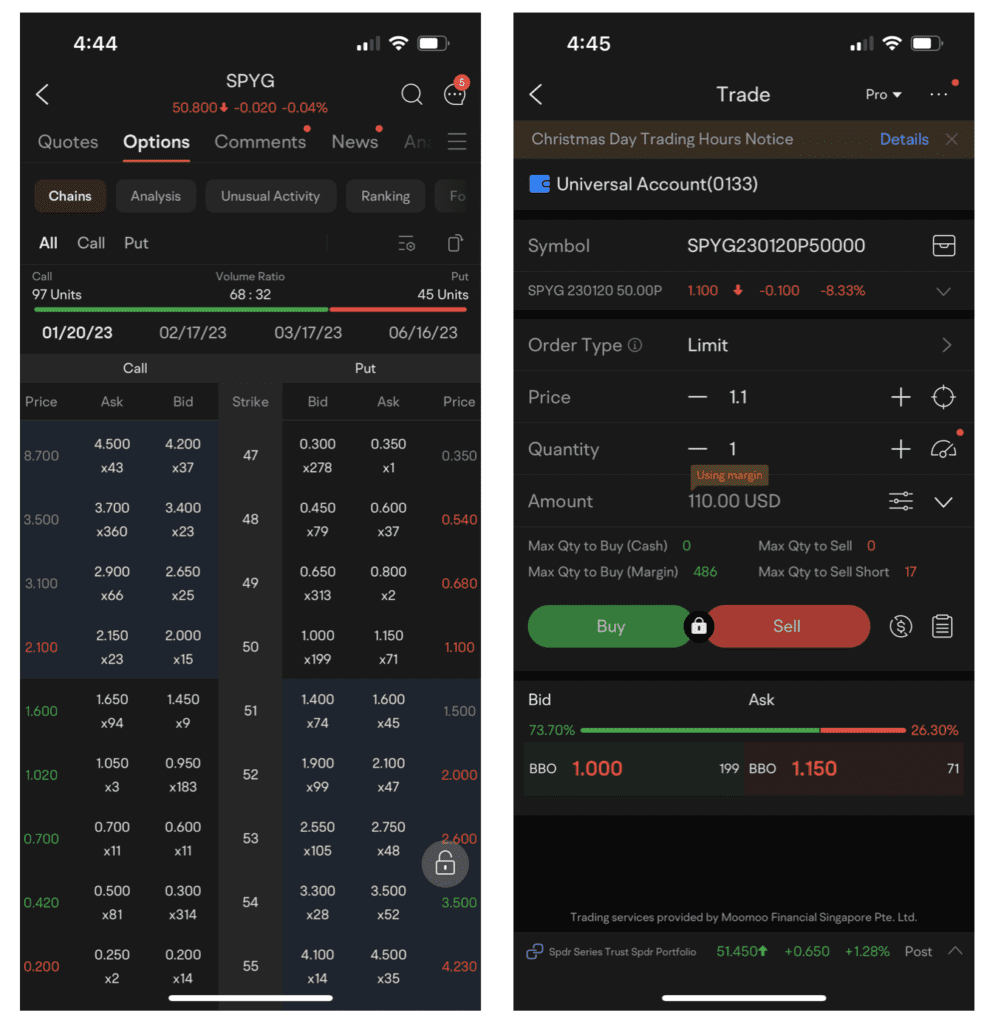

You can either buy stocks directly, or you can use sell put options, and promise to buy 100 shares of SPYG at $50 per share, and in return, you will get to collect some premium as a form of passive income for making this promise. Later on, I am going to log in my moomoo platform to show you how you can do it step-by-step.

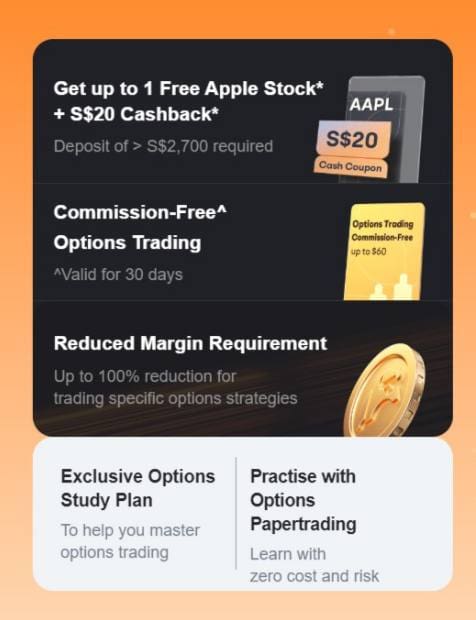

Right now, moomoo even offers 3-month free in-depth options data to my followers and one free “options kit” which includes 1 month of free commission, option learning courses, and options paper trading for your options trades. They even offer lifetime free commissions for US stocks and ETFs. So do register an account and fund $2700 SGD to get a free share including Apple!

To execute this sell put options trade, how much capital do you need? By choosing the strike price to be $50, that will be $50 x 100 shares = $5000!

How much return do you get? You will get to collect about $110 of premium in 1 month. That’s a good 2.2% ROI in a short 1 month.

But you must be wondering, what is the risk of this trade? There are only 2 scenarios that can happen.

Scenario 1

If after 1 month, the stock price of SPYG stays above $50, let’s say $55, because right now you are offering to buy the stocks at $50, nobody is going to them to you since they can sell to the market at an even higher price, you won’t be able to buy the shares, but you still get to collect the $110 worth of premium in the first place. That’s free money!

Scenario 2

In this scenario, the stock price drops to $45 after 1 month. Since you have made the promise to buy SPYG at $50, you now need to fulfill the promise, and buy 100 shares at $50 each. That’s why you need to make sure you have $5000 capital in your brokerage account in the first place, to ensure you can execute this options trade safely.

Should scenario 2 happen, do you need to feel sad? Because it seems that you are suffering losses at the moment. But remember, index fund investing is all about dollar cost averaging regardless of the market movement. In the short run, the market can drop further, but in the long run, the market always rebounds and grows even higher. That’s why if you manage to get 100 shares of SPYG, you should be happy and time will do its magic!

Can you retire with a million dollars? Yes, You Can!

The next thing you can do is rinse and repeat this strategy every single year. However one downside of this strategy is, as the stock price of SPYG continues to grow, you will need more and more capital to execute this options trade. So if you want to keep it simple, you can also simply buy SPYG stocks with $5000 every single year, and grow your million-dollar retirement portfolio.

This is just one of the options strategies that you can consider using for your portfolio. And if you also want to learn more options strategies, you can join us in our free options masterclass to get started. All you need to do is to sign up for your free spot.

If you find this post helpful, you can also watch the video below to learn about sell put SPYG navigation through moomoo step-by-step below.

Do follow my telegram channel too for more investing insights. With that, I wish you a wonderful 2023 and a prosperous year ahead!