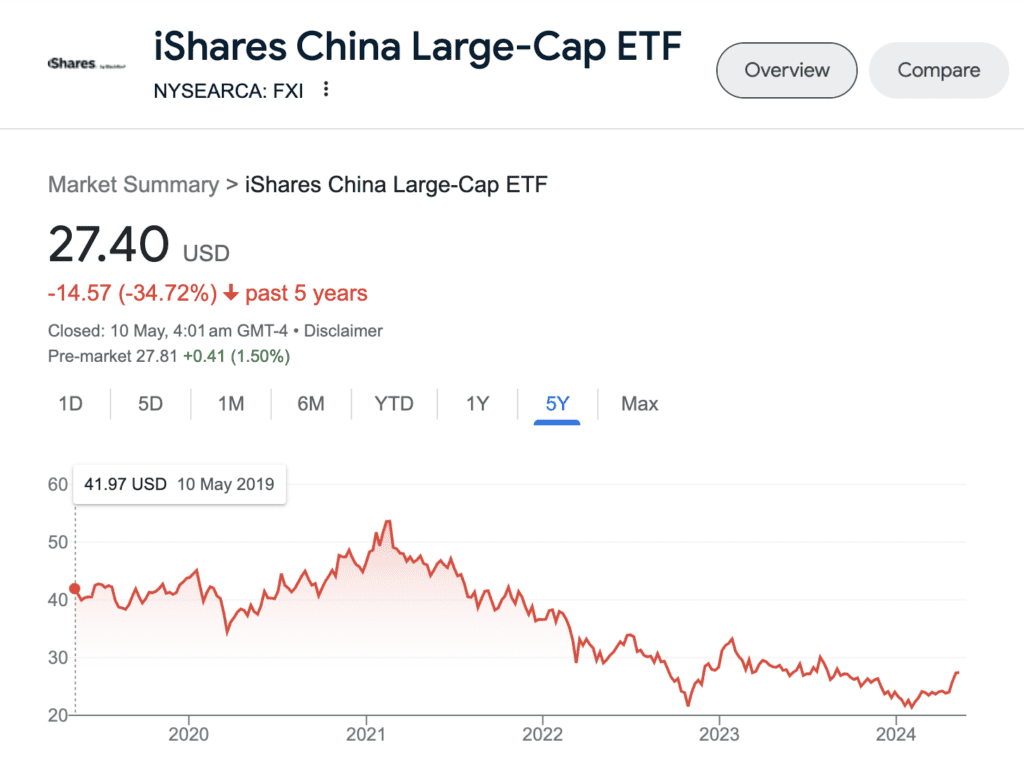

China’s stock market has fallen close to 35% over the past five years. Should you invest in China right now? 🤔📈

When it comes to learning about a complex market like China, the best approach is often to learn from people who live and breathe there. 🇨🇳

I recently had an honour to interview a leading China tech expert, Jeffrey Towson 陶迅 and I learnt a lot from our discussion. Jeffrey is the founder of TechMoat Consulting and a keynote speaker specializing in the digital strategies of top tech companies in the US, China, and Asia.

You can watch the entire full 1-hour discussion here!

Apart from Jeffrey Towson, Li Lu, a prominent investor who Charlie Munger called the Warren Buffett of China, shares in his book “Civilized, Modern, Value Investing and China” that China’s long history and cultural emphasis on success make it unlikely for the country to permanently fail.

**Why China Will Likely Recover**

China’s Resilient People: Chinese culture is built on hard work and a strong sense of national pride. Having overcome challenges for millennia, the Chinese people are unlikely to accept long-term decline.

The Power of Free Markets: Even during downturns, free markets can provide opportunities for investors with a long-term perspective. Value investing principles can still be applied to find undervalued companies.

**A Personal Connection**

Having grown up in China before moving to Singapore at 15, I can personally relate to what Li Lu means by “The Chinese people and culture, after thousands of years of success, are not willing to fail.” The Chinese people are incredibly hardworking and take great pride in their culture and history. Throughout its long history, China has faced and overcome many challenges. This perseverance suggests that China’s future success is likely, as long as it remains open to the world.

**The Importance of Openness**

Global Integration is Key: Li Lu believes that isolationism hurts a country’s growth. China’s continued participation in the global free market is crucial for its long-term success.

Free Markets and Long-Term Growth: China’s commitment to a free market economy, science, and technology will likely lead to long-term economic growth, similar to what mature market economies have experienced over the past centuries. Value investing will likely remain a successful strategy in China, just as it has been in other markets.

**The Bottom Line: Invest for the Long Term**

While nobody can predict exactly when China’s market will recover, a long-term perspective is key. By focusing on value investing and maintaining a margin of safety, investors can potentially find opportunities in the current market downturn.

Do you agree? Are there other factors to consider when evaluating China’s investment potential? Can’t wait to hear your thoughts 😊

Meanwhile, feel free to follow my telegram for more investing insights!

You can also check out my interview with best selling author William Green to learn more about investing!