With the rising cost of living and never-ending increasing interest rates, if you have been investing in the stock market for the past 2 years, you may be sad to see most of your profits go to drain, or worse turn into losses. You might be wondering: “How to set up retirement plan with SRS investing if the market continues to drop?”

But please do not give up on investing. It is exactly times like this that serve as a good reminder that investing is not about getting rich quickly, but about getting wealthy permanently. And in order to build up a permanent wealth-creation retirement portfolio, we must first adopt a long-term investing horizon.

The definition of long-term here, I am talking about the next 15-20 years. If you want to get rich quickly in the next 1-2 years, then this post is not for you. But if you are keen to build a lasting retirement portfolio that’s close to half a million dollars for yourself in the next 15 years, then keep on reading!

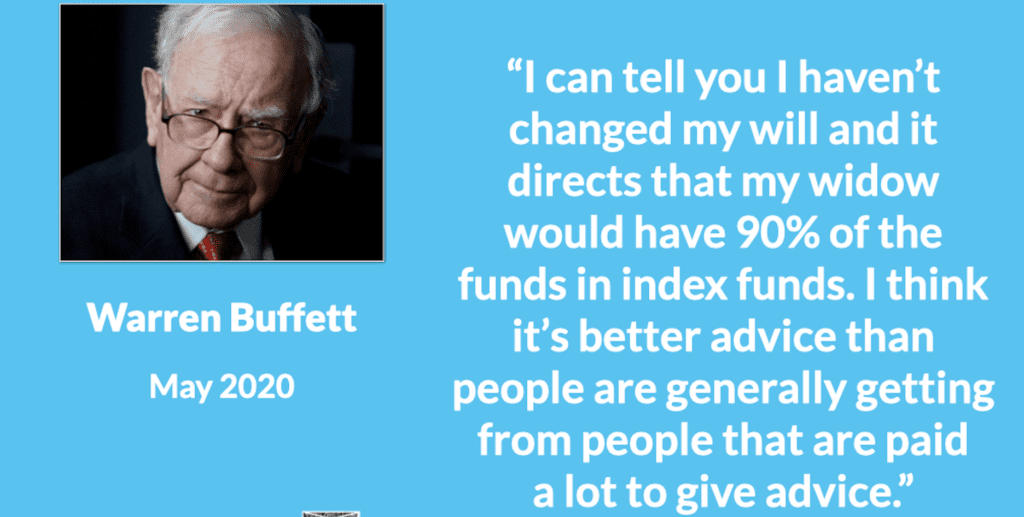

Retirement Planning Advice from Warren Buffett

The advice I am going to give you is from the greatest investor Warren Buffett. In Buffett’s 2013 letter to Berkshire Hathaway’s shareholders, he pointed out, “In aggregate, American business has done wonderfully over time and will continue to do so (though, most assuredly, in unpredictable fits and starts).” He stated that non-professionals should simply invest in”a low-cost S&P 500 index fund…”

How serious was Buffett about this recommendation? He even put similar instructions in his will for how his cash should be invested for the benefit of his family after he passes on. Buffett revealed that he will invest 90% of the money into S&P500. 90%!! That’s the amount of conviction he has!

But if you are thinking: “What if the market drops further from here? I should wait a bit more before investing…”

Well… Warren Buffett has another piece of advice for you. He said: “The antidote to that kind of mistiming is for an investor to accumulate shares over a long period and never to sell when the news is bad and stocks are well off their highs.”

In other words, don’t try to time the market, because nobody can. Buffett’s recommendation would probably be to buy an S&P 500 index fund now and keep buying on a regular basis. The most important caveat is that you shouldn’t sell in an attempt to avoid a loss.

And in the long run, your wealth will compound.

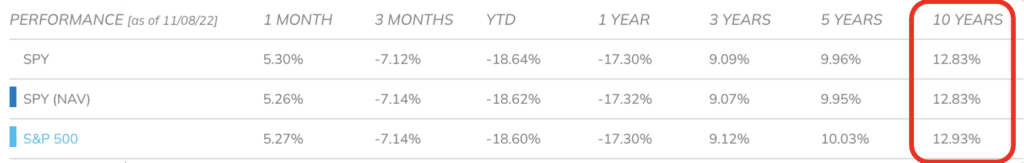

If you look at S&P 500 performance for the past 10 years, it has gone up close to 200%. Your annualise return is about 10% per year. Based on this past track record, if you continue to invest in the index for the long run, you are likely to build a solid retirement portfolio for yourself, without having to worry about the ups and downs of the market.

What does it have to do with SRS investing?

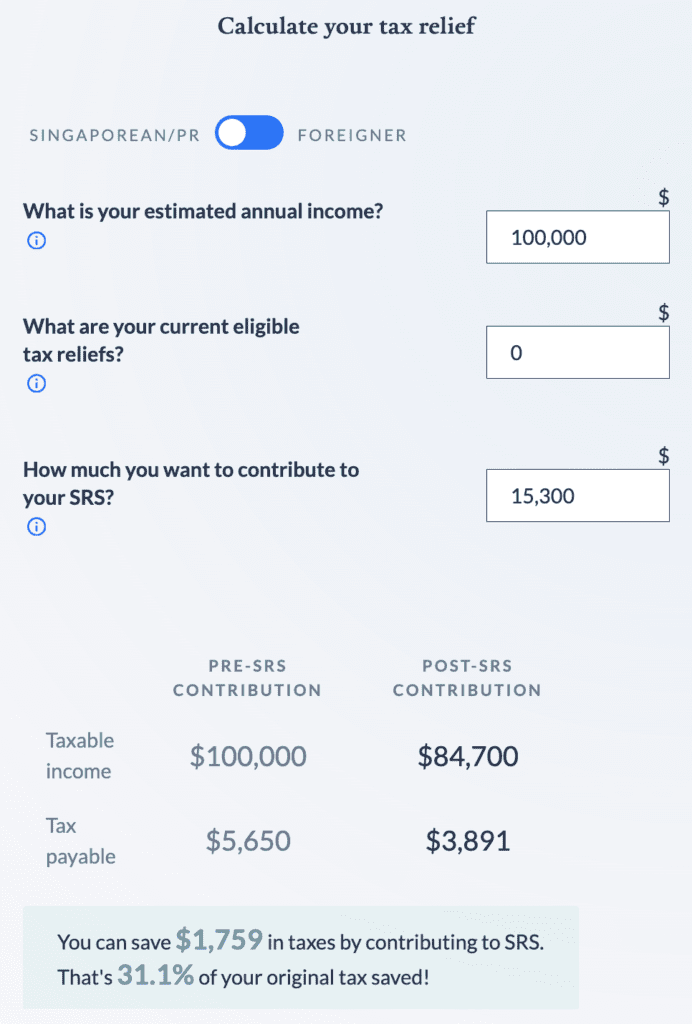

If you are a Singaporean or foreigner working in Singapore, you have the additional advantage of saving on your taxes, by investing in your SRS account. Let me explain!

Firstly, what is SRS? It stands for Supplementary Retirement Scheme, a voluntary program set forth by Singapore’s Ministry of Finance that encourages both Singaporeans and foreigners to save more for retirement by offering attractive tax incentives to those who participate.

If you have an annual income of $100,000, by contributing a maximum of $15,300 to your SRS account, you will enjoy $1,759 tax savings, that’s over 30% of your original tax saved!

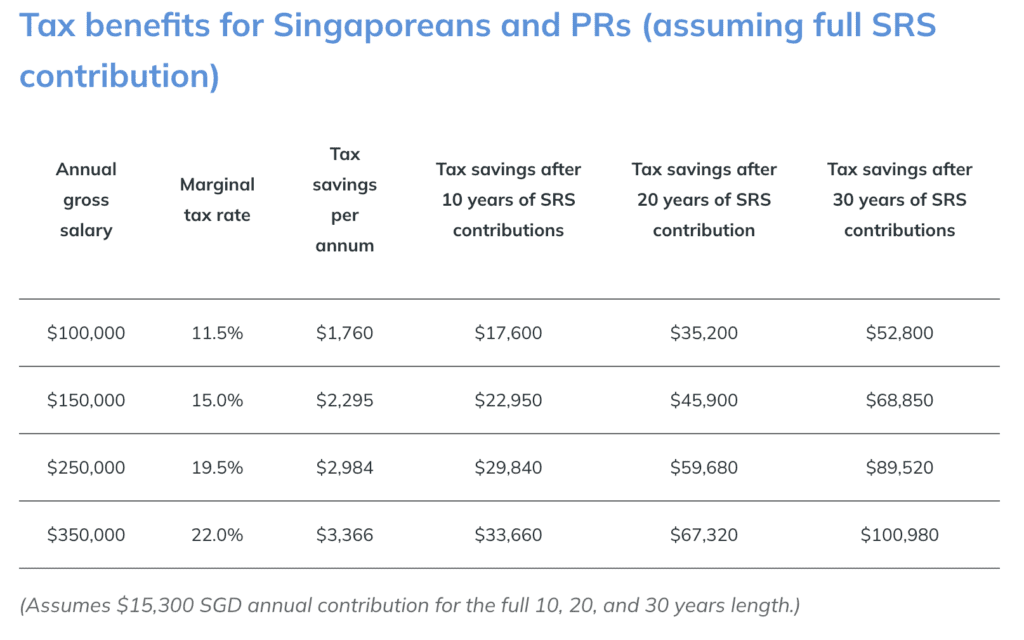

And if you have an even high income, eg 150k- $350k, you will enjoy an even higher tax savings of $2300 to $3300 per annum. And if you continuously contribute to your SRS in the next 20 years, you get to save from $35k to $67k just on taxes themselves. This would be the money you pay to the government anyway, so why not save it by topping up your SRS?

Remember, in order to enjoy tax savings, you need to contribute to your SRS by 31 Dec this year, so make sure to start doing now, so you can make it in time for the handsome tax savings!

SRS Investing Reason

After you top up your SRS, what should you do next? You must INVEST IT!

If not the money will only give you 0.05% interest per year…

And you want to invest your money into a low-cost index fund like Warren Buffett advised, which can give you an average of 10% return in the long run.

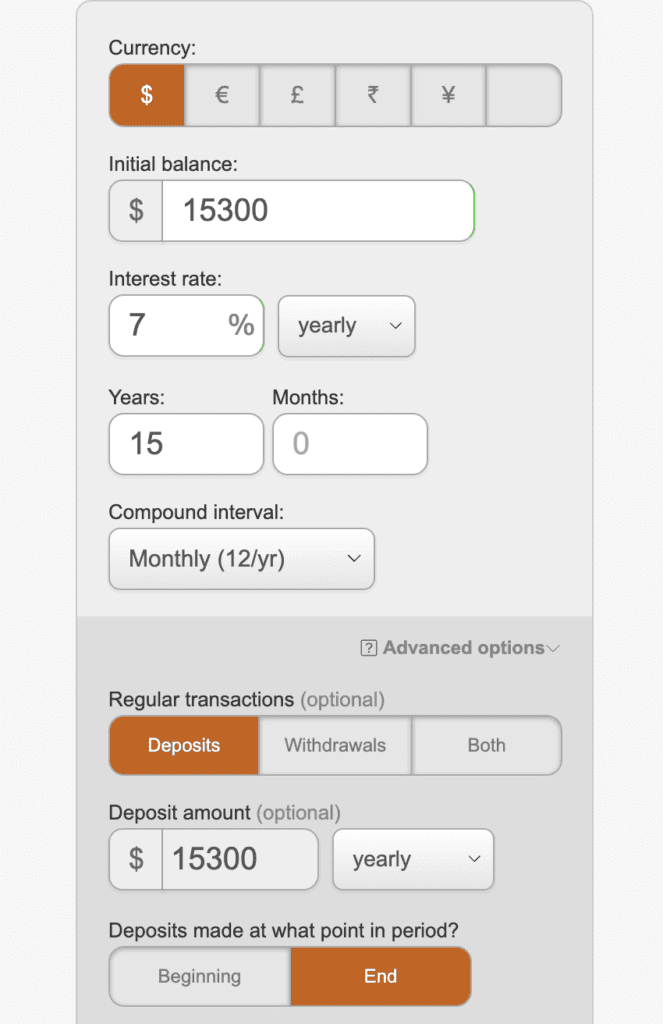

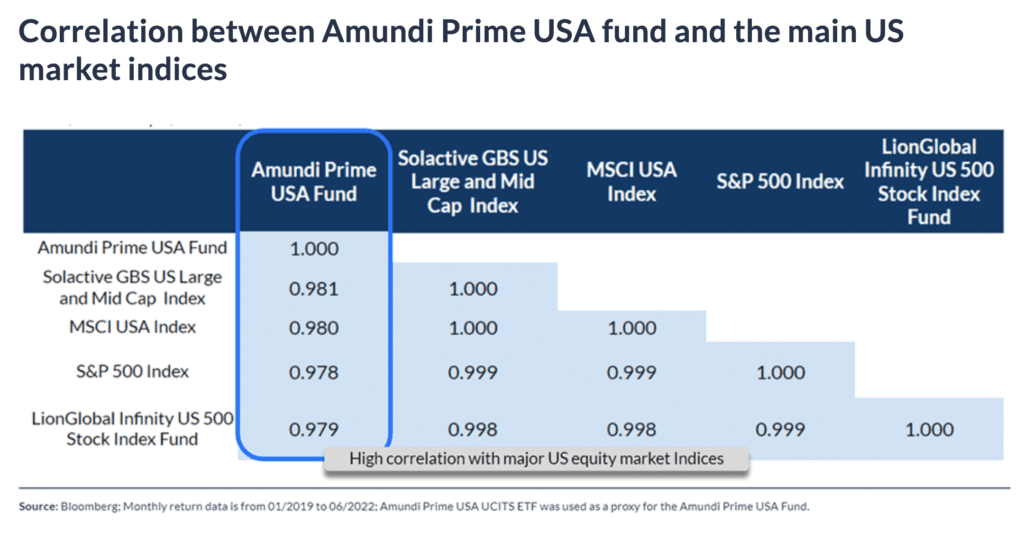

Now imagine from now on every year you continue to fund your SRS account with 15300, and just invest in an index fund like S&P500, and let’s be more conservative, instead of 10% return, you only get a return of 7% in the next 15 years, how much money will you have for your retirement?

The answer is a whopping $400,000!

Why do we want to aim for this number? I will share with you why later!

SRS Investing Step-by-step

For myself, I use Endowus, a low-cost platform licensed by MAS to invest my SRS.

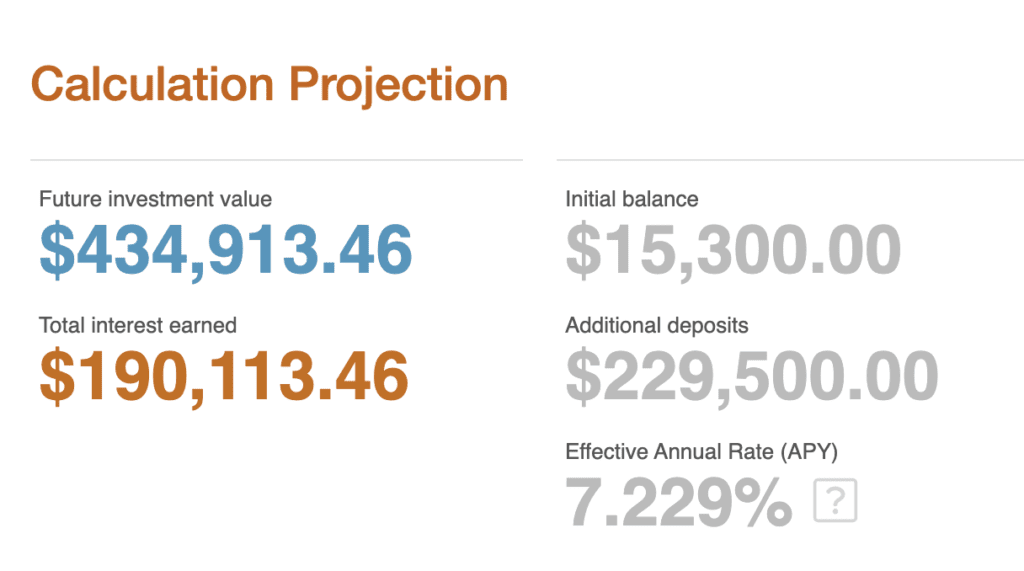

The reason why I chose Endowus is first that it’s low-cost, and secondly, it allows me to access EXCLUSIVELY certain very low-cost fund that replicates the S&P500.

Previously, I use Infinity 500, but now I’ve found an even cheaper fund available to Endowus users only, which is Amundi Prime USA Fund, with an expense ratio of only 0.05%, much lower than 0.61% by Lion Global Infinity 500.

Amundi is a French asset management company. With €2 trillion of assets under management at the end of 2021, it is the largest asset manager in Europe and one of the 10 biggest investment managers in the world.

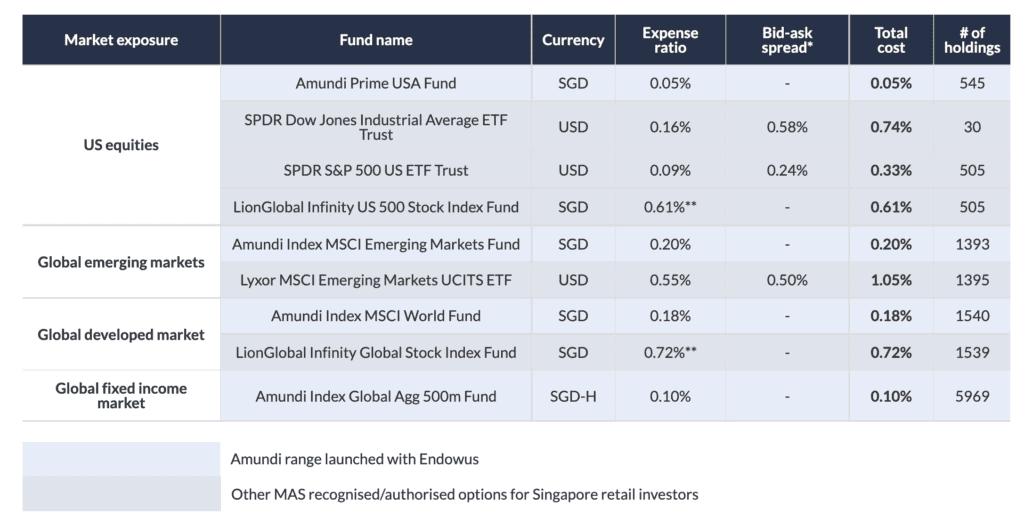

And the result of this fund tracks very closely to S&P500 performance, which is exactly what Warren Buffett advised, investing in low-cost index funds.

The below table shows the % correlation between the different funds to S&P500 performance. You can see that Amundi Prime USA and S&P500 have a correlation of 0.978, which is very high.

How to Set Up Monthly Recurring SRS Investing?

Every month through Endowus, I set it to be a recurring SRS investment so I can continue to do dollar-cost averaging regardless of the market condition. If you want to learn how to do it, check out the video below.

If you also want to start using Endowus to invest your SRS, you can open your account from my link and you will get $20 access fees to waive off your investment fees when you fund your first $1000!

When to Withdraw SRS Investing Portfolio?

You can withdraw SRS anytime, but there’ll be a penalty of 5% if you withdraw before your SRS the official retirement age set by the Singapore government. From 2022, the statutory retirement age will increase to 63. So only contribute money that you don’t need into the SRS account.

In Singapore, we are not required to pay any tax on the first $20,000 of chargeable income. As only the first 50% of our SRS withdrawals will be considered chargeable income, we can withdraw up to $40,000 per year without having to pay any income tax.

That means after your retirement, with your $400k portfolio inside your SRS, you can withdraw $40k income from your SRS every year tax-free for the next 10 years woohoo! That’s why I aimed for a $400k portfolio earlier!

Anything above that, you may have to pay some taxes on your withdrawals. But it’s definitely a good problem to have!

What else apart from SRS investing?

Apart from SRS investing, I also do options investing to accelerate my portfolio growth. If you’re wondering what options trading strategies really work, the power of options lies in you can generate income and protecting your portfolio even in this volatile market condition. If you want to learn more, do join us in our free 2-hour Next Level Options Masterclass to learn 3 powerful options strategies to get started! All you need to do is to click on the link below to register for your free spot!

Lastly, the information shared here is not investment advice. Please do your due diligence before making any investment decisions. And remember to follow my telegram for more investment updates!