With the collapse of Silicon Valley Bank, Signature Bank, Silvergate Bank, and now many other banks in trouble, many investors are left to question, whether is it still safe to invest in banks. You must be wondering: “How to invest money with banks safely?”

But we all know, Warren Buffett said, “Be fearful when others are greedy and greedy when others are fearful.” With the extreme fear in the financial market, there must be some investment opportunities waiting to be seized.

That’s why in this post, I will share with you how to invest in banks and analyse which banks are safe to invest in, so we can reap some handsome rewards safely from this crisis!

When considering how to invest money with banks, there are several metrics you should look out for to assess the bank’s financial health and potential for future growth. In this video, I will use Bank of America and the recently failed SVB as an example, so you can learn to analyse how to invest in banks too! Here are some of the most important metrics to consider on how to invest money with banks.

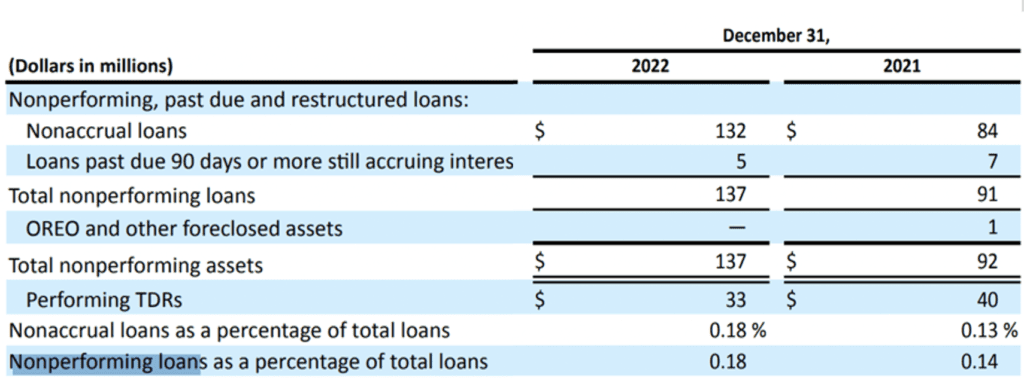

How to invest money with banks metric 1: Non-Performing Loan / Total Loans

In order for banks to make money, they need to loan out their money to earn interest. However, if the borrowers have no ability to pay back, it will become a huge problem just like what happened back in the 2008 financial crisis. That’s why the first metric to check is its Non-performing loan ratio. This metric measures the percentage of a bank’s loans that are not being repaid on time. A high NPL ratio indicates that a bank has a higher risk of default and is therefore more financially unstable.

That’s why we want the ratio to be as small as possible, with a maximum of 2% to be safe.

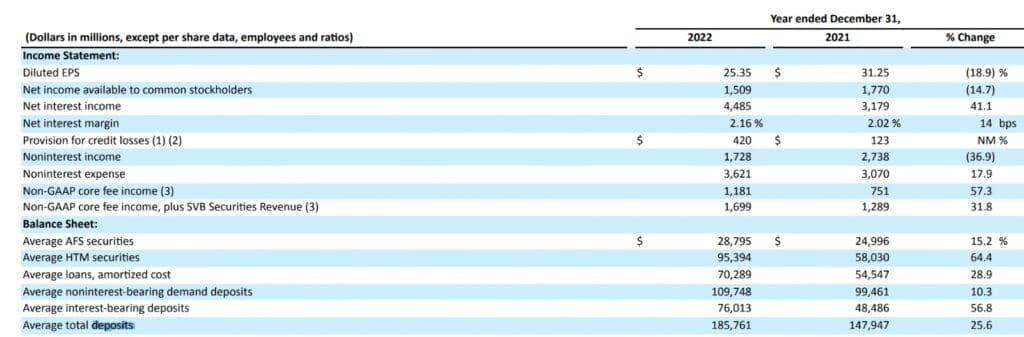

By looking at SVB’s nonperforming loan to total loan ratio, it remained to be a very healthy ratio of 0.18%.

For BAC, it was 1.22% for the year 2022, which is also within the reasonable range too.

So based on this metric, SVB shouldn’t have failed. That means we need to dig even deeper and look at another metric.

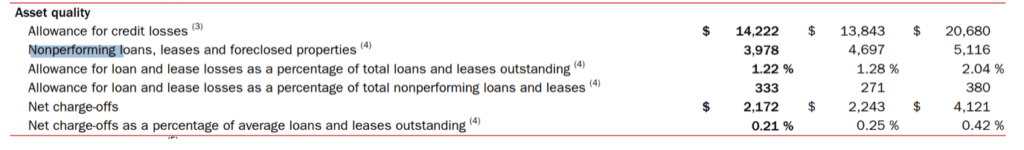

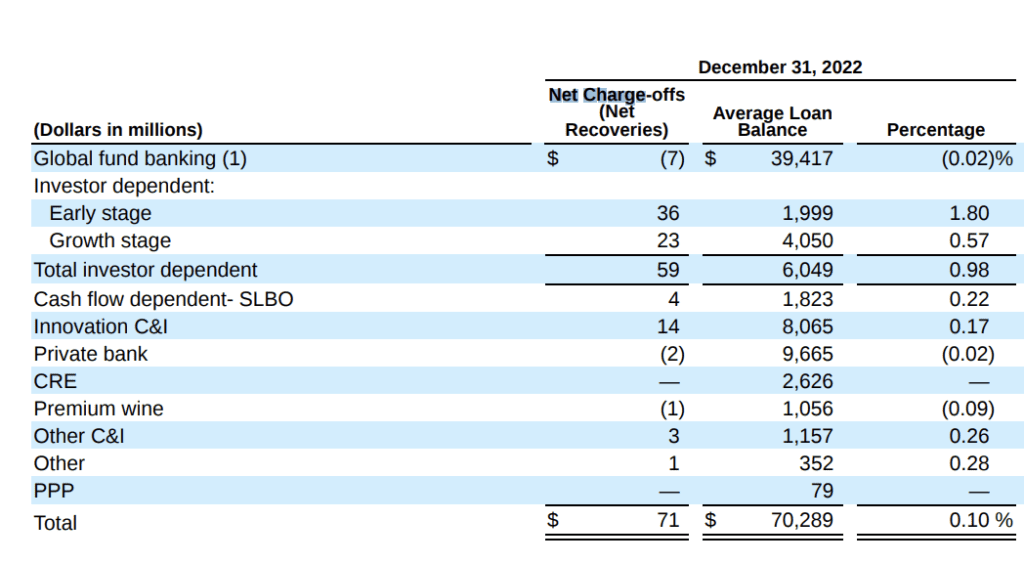

How to invest money with banks metric 2: Net Charge-Off Rate %

If there’s a chance to collect back non-performing loans, when it comes to Net charge-offs, there’s no chance at all. Also known as bad debts, net charge-offs are loans that the bank has deemed irrecoverable and will be written off as an expense.

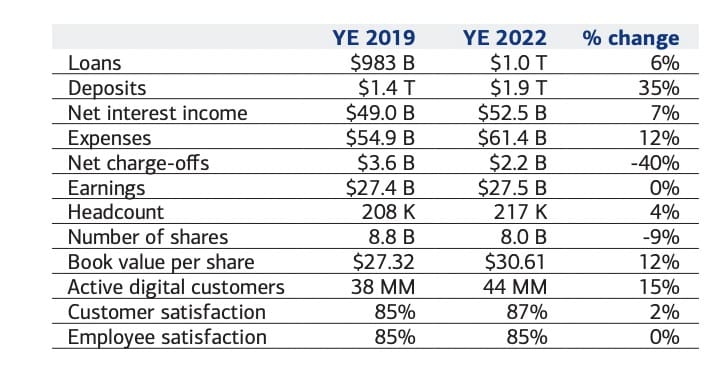

If you look at BAC, it has a net charge-off rate of 0.21%. In fact, inside my private telegram, I also shared with my followers that BAC has been maintaining a very low rate since the 2008 crisis, be it in the commercial, consumer, or even credit card segment. If you haven’t joined my telegram, make sure to do so to get more latest investment updates, for free!

If you look at the net charge-off rate of SVB, it was also very low at 0.1%. It shows that just by looking at these 2 metrics, it is still not enough to tell if the bank is safe to invest in or not! So let’s look at the next criteria.

How to invest money with banks metric 3: Growth In Deposits

The only way for a bank to grow its earnings is to issue out more loans and earn interest income. However, it needs money in the first place before it can lend out money. One of the ways banks get more money is to grow the number of deposits from customers. On the other hand, if the bank has been consistently having fewer and fewer deposits, it can be a sign of trouble. So let’s take a look at SVB!

As you can see, SVB has been growing its deposits by more than 25% compared to 2021.

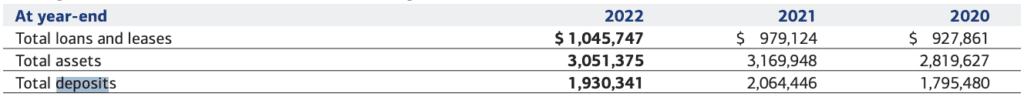

While for BAC, deposits decreased by about 6.5% as compared to the year 2021.

You must be wondering, if that’s the case, SPV looks like a better bank isn’t it? Why did it fail eventually?

Well, that’s because we haven’t looked at the next metric, the size of the deposit.

But before that, if you are new to investing and are wondering what brokerage account to get started with, try out Webull! Webull is a commission-free stock trading app that is very user-friendly. It provides you with real-time market data, customizable charts, technical indicators, and news alerts. It also includes useful company financial insights such as EPS, ROE, ROA and more.

Regulated by the Monetary Authority of Singapore, investors are also protected by up to $500,000 against their portfolio.

Right now when you open your Webull account via my link below, you will even get free shares of at least $50 USD to up to $500 USD, with any amount of deposit! That means a deposit of $0.01 also works, that’s at least a 5000% return just for opening your account! All you need to do is to open your account here today!

How to invest money with banks metric 4: Size Of Deposits

Although SVB enjoys a 25% deposit growth rate YOY, its size is only 185 billion, as compared to the BAC which has 1.9 Trillion dollars in deposits!

The sheer size of the deposit makes BAC a much safer bank to invest in because most of the deposits come from normal people living in the US. It’s very unlikely that all Americans decided to take out money from the bank and keep cash in the house. Because the thought of it sounds even more unsafe!

And with the government’s assistance to ensure the stability of the financial sector, people will have more confidence in big banks like BAC rather than small regional banks like SVB.

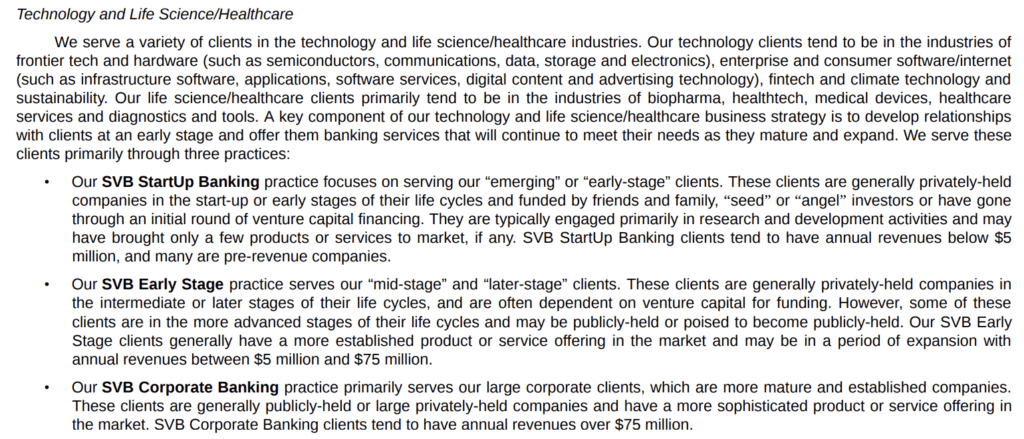

On the other hand, most deposits of SVB are from tech start-ups, venture capital firms, and private equity, which are a lot less stable in nature. When all of them decide to withdraw cash after signs of trouble emerged, that’s what caused the bank run which eventually made SVB collapse.

But of course, analysing banks takes more than just looking at the above 4 metrics, investors should also look at other investing criteria like Return on assets (ROA), Loan portfolio, Net interest margin (NIM), and so many more!

Just like Warren Buffett said, it is actually a lot more difficult to understand companies in the financial sector like banks than simple businesses like Coca-cola and see’s candy. Check out what Warren Buffett has to say via my video below!

So if you don’t understand individual banks well enough, but you still believe in the long-term growth of this sector, you can consider investing using ETF instead!

How to invest money with banks metric 5 – Financial ETF (XLF)

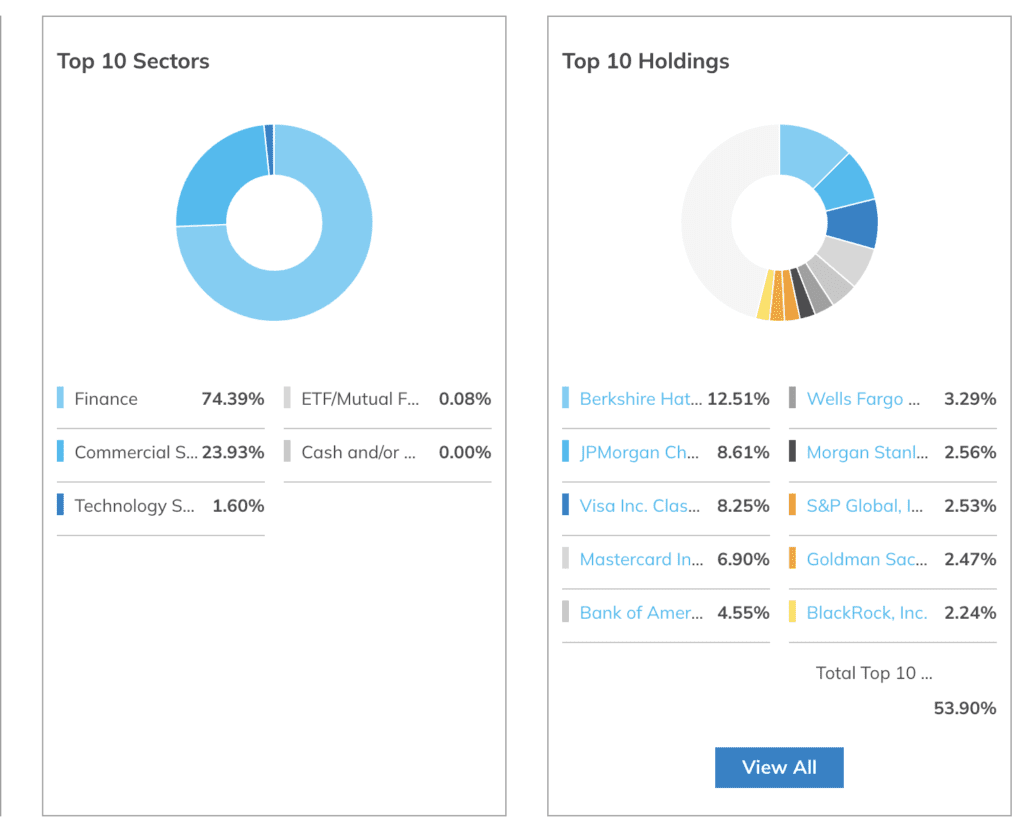

By investing in XLF, you immediately build a portfolio with all these strong companies working for you, including Warren Buffett’s Berkshire Hathaway, JP Morgan, Bank of America, SPGI, Amex, and more! And for the past 10 years, this ETF has generated investors about 10% return per year, pretty decent isn’t it?

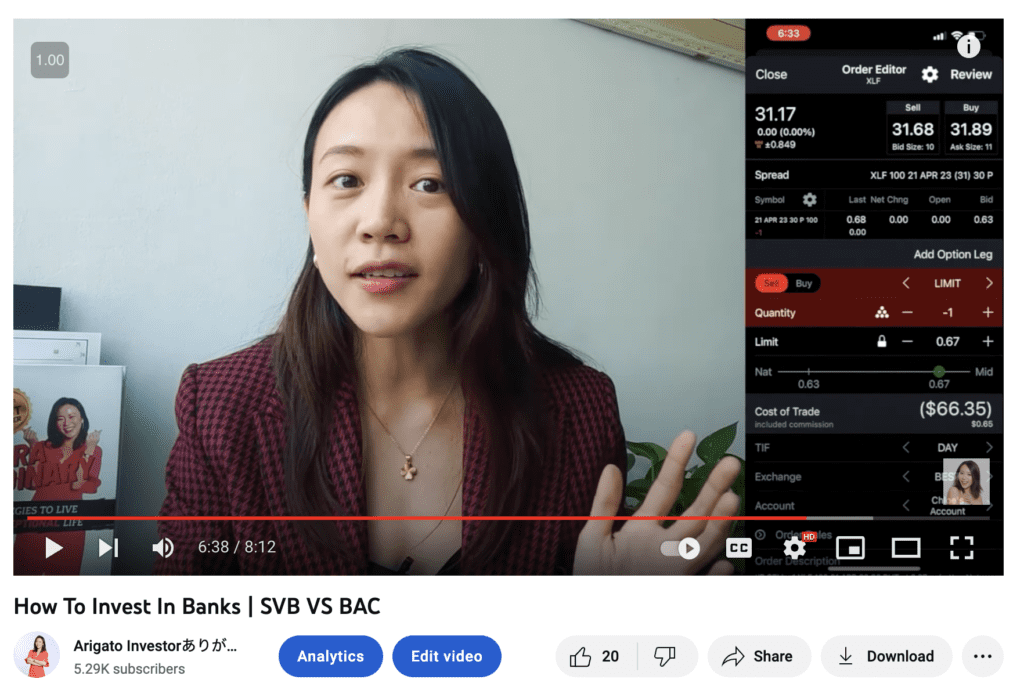

The current stock price is about $31, and if you know how to use the B.O.S.S options strategy, you can even buy XLF cheaper than the current market price, thus lowering your risk!

For example, by doing the B.O.S.S options strategy and promoting to buy the stock at $30, you will get to collect $67 passive income in about 30 days. That’s a 2.2% return in 1 month!

Of course, there are different options strategies for you to use in different market conditions. If you want to learn what options trading is and how to get started investing using options to collect passive income consistently, do join us in our upcoming free 2-hour Next Level options masterclass where we will share with you 3 different options strategies to profit from the stock market!

How to invest money with banks — Conclusion

With the dramatic collapse of SVB and the lingering fear in the financial market, it shows that a black swan event can happen anytime anywhere. I learned that it’s very important to only invest in something that you truly understand, and always be ready to ask yourself, what if I am wrong? Am I willing to take the risk? If you are not, then don’t invest in the company.

But if you do, make sure you do position sizing so your portfolio won’t go down as the company goes bust! And if you are really unsure what to invest in, it’s always good to begin with ETFs!

What’s your greatest takeaway from this financial crisis? Comment down below and let me know your thoughts!

In the meantime, don’t forget to join my telegram channel as I constantly share a lot of insights over there! Check out my Top 10 Investing Tools 2023 to level up your investing too!