Many people often mistake Berkshire Hathaway for an investment holding company. They think that by buying Berkshire Hathaway stock, they are simply acquiring Warren Buffett‘s holdings in Apple, Bank of America, Amex, Coca-Cola, and 50 other publicly listed companies. However, that is not true because Berkshire is much more than that.

Berkshire Hathaway is a conglomerate holding company that owns a diverse range of companies, including those in the insurance, railroad, manufacturing, energy, utilities, and even candy-making industries. It has a super diversified business portfolio that can withstand various economic conditions.

In this article, I will break down what Berkshire Hathaway truly owns and explain why you should consider buying Berkshire Hathaway stocks.

Berkshire Hathaway’s Business Model

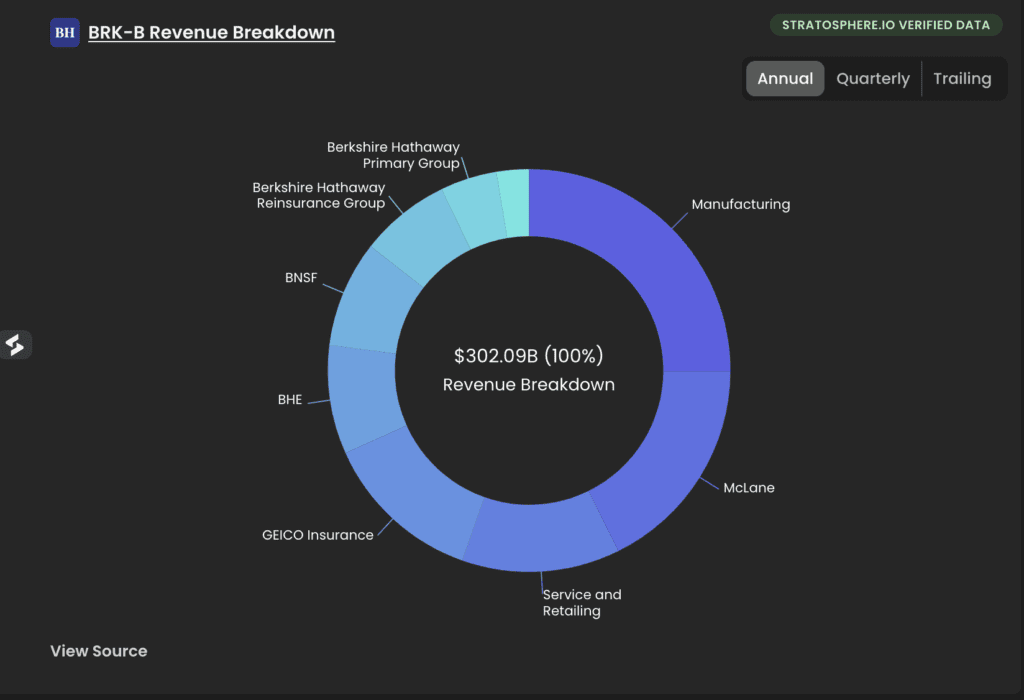

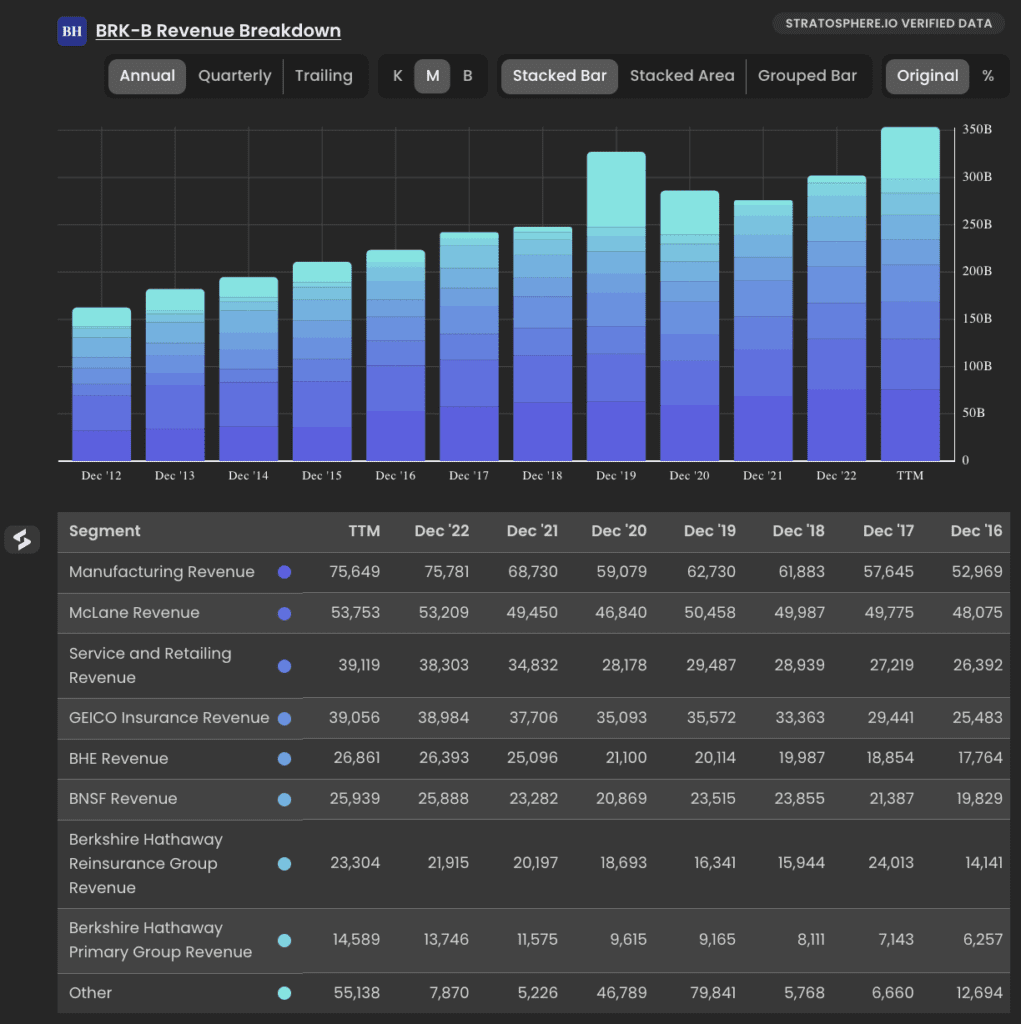

Berkshire Hathaway’s business model involves owning a diverse range of subsidiaries and making investments in various companies. The company’s revenue breakdown shows that its largest revenue segments are manufacturing, McLane, and GEICO Insurance.

Now let’s examine the key businesses together.

Berkshire Hathaway Insurance

Berkshire Hathaway’s insurance operations brought in total revenue of $75.65 billion, representing 25.04% of their total revenues, in 2022. Holdings include GEICO, Berkshire Hathaway Primary Group, and Berkshire Hathaway Reinsurance Group.

You might be wondering why Buffett would want to own insurance companies considering the risks involved in running such businesses. After all, accidents, natural disasters, and diseases are unpredictable. The reason is that by owning insurance companies, Buffett and Munger can tap into the power of float.

So, what exactly is float? The concept is straightforward. When you purchase an insurance policy, do you pay the money upfront or later? The answer is upfront. However, when an insurance company pays you after an accident (touch wood), it is later.

This collect-now, pay-later model gives insurance companies a golden window of time to hold large sums of money, which we call “float.” They can invest this float to generate additional income.

In fact, the insurance business has been the driving force behind Berkshire’s growth since 1967. As you can see, the amount of float that Berkshire owns has grown tremendously over the past 50 years, from an initial $39 million to $164 billion in 2022. This provides Buffett with a substantial pool of cash to invest in and acquire more businesses.

Furthermore, it is important to note that despite suffering a small underwriting loss in 2022, Berkshire has an excellent underwriting record. The company has operated at an underwriting profit for 18 of the last 20 years, with the exceptions being 2017 and 2022. Over the entire 20-year period, their pre-tax gain totaled $29.2 billion.

Technically speaking, the company received $29 billion for using the free insurance money “float” to invest and generate even more investment income.

This impressive record is not a coincidence. As stated in Berkshire’s annual report, “Disciplined risk evaluation is the daily focus of our insurance managers, who know that the rewards of float can be drowned by poor underwriting results. All insurers give that message lip service. At Berkshire, it is a religion, Old Testament style.”

Berkshire Hathaway’s Distribution Business — McLane

In 2022, Berkshire’s McLane Company generated revenues of $53.21 billion, which accounted for 17.6% of the total revenues.

McLane primarily offers wholesale distribution services to Walmart, which contributed around 16.5% of McLane’s revenues in 2021. Other significant customers for McLane include 7-Eleven (approximately 13.9% of revenues) and Yum! Brands (approximately 11.5% of revenues).

Additionally, McLane distributes distilled spirits, wine, and beer to various companies, supplying nearly 50,000 retail units across the country.

The key advantage of McLane lies in its size. The company’s business model relies on high sales volume, rapid inventory turnover, and strict expense controls. The distribution industry generally operates on thin profit margins. Even Amazon, known for constructing one of the largest and most efficient distribution systems in the United States within a couple of decades, does not make substantial profits from its distribution operations. Despite investing billions of dollars in building its distribution network, Amazon’s return on investment remains negligible.

These economies of scale present both benefits and drawbacks for companies like McLane and Amazon. It could be considered a necessary evil because without those slim profit margins, they would have faced stiff competition and never been able to develop their extensive networks.

Any competitor attempting to replicate the distribution network established by these businesses would have to spend tens or even hundreds of billions of dollars to achieve the same operational efficiency and scale. However, the return on investment would be meager, and the payback period would span several decades. From an investment perspective, there are much more attractive opportunities available if you’re seeking quick returns.

Therefore, although McLane may not be the most profitable company, it possesses a wide and deep competitive advantage, which aligns with the investment criteria sought by the Oracle of Omaha. This advantage significantly increases the likelihood of the company generating profits and cash flow for many decades to come.

Berkshire Hathaway Manufacturing

Berkshire Hathaway’s manufacturing division is a crucial component of the company’s revenue. In 2022, these manufacturing businesses collectively generated $75.78 billion, representing 25% of the total revenue. The division encompasses industrial products, building products, and consumer products.

Notable acquisitions include Precision Castparts, which produces high-quality metal components for aerospace and power applications. Lubrizol Corporation is a leading manufacturer of specialty chemicals used in various industries. International Metalworking Companies (IMC), also known as ISCAR, manufactures metal cutting tools. Marmon Holdings operates across diverse segments such as food service technologies, water technologies, and retail solutions.

In the building products segment, Clayton Homes is the largest supplier of manufactured and modular homes in the US. Shaw Industries is a prominent carpet manufacturer, while Johns Manville specializes in building solutions. MiTek Industries provides construction products and services, and Benjamin Moore manufactures architectural coatings. Acme Brick specializes in clay bricks and concrete blocks.

These manufacturing businesses contribute significantly to Berkshire Hathaway’s revenue and strengthen its presence in diverse industries.

Berkshire Hathaway Railroad

Berkshire Hathaway also owns railroad company BNSF (Burlington Northern and Santa Fe Railway), one of the largest railroad systems in North America.

It also has several utilities and energy companies under its subsidiaries, serving approximately 5.2 million customers and five U.S. interstate natural gas pipeline companies.

Berkshire Hathaway Service and Retailing

Berkshire Hathaway also has Service and Retailing side of business, producing products across all these sectors. It consists of a range of other businesses, which include Borsheim Jewelry, Helzberg’s Diamond Inc., Ben Bridge Jeweler, See’s Candies, The Pampered Chef, Oriental Trading Company, and Detlev Louis Motorrad.

All these businesses are making consistent cashflow for Berkshire, for Warren Buffett and Charlie Munger to invest more!

Berkshire Hathaway Investment Arm

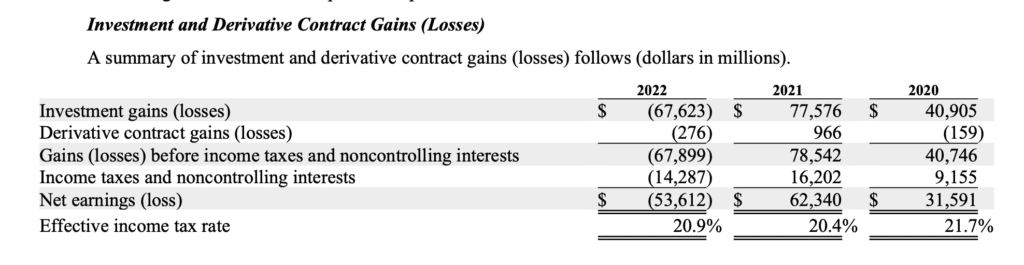

Now, finally, let’s discuss the most well-known investment side of the business: Berkshire Hathaway’s investment portfolio, which incurred a total loss of $53 billion in 2022.

Before jumping to conclusions about Warren Buffett’s prowess as an investor, it’s important to understand the context in which gains or losses are calculated. Stock prices fluctuate daily, making it impossible for any investor to consistently make money from the stock market every single day or year. Therefore, when the overall market experienced a significant decline last year, Berkshire’s investment portfolio was also affected. Although it appeared that Berkshire had lost $53 billion on paper, this loss was unrealized.

In other words, Berkshire did not sell the stocks at a lower price than what it paid for them. The loss was simply a result of share prices falling during 2022, as per accounting standards.

However, just as we shouldn’t judge a book by its cover, we shouldn’t evaluate a company based on its performance in a single year. Warren Buffett himself stated, “We believe that investment gains and losses, whether realized from sales or unrealized from changes in market prices, are often meaningless in terms of understanding our reported consolidated earnings or evaluating our periodic economic performance.”

Instead, our focus should be on the long-term business performance of the companies we invest in. When a business performs well, the stock eventually follows suit.

Berkshire Hathaway Shareholder Return

This is evident in Berkshire Hathaway’s track record since 1965, during which it generated an annualized return of 19.8% for shareholders, compared to the broad market return of 9.9%.

To put it into perspective, if you had invested $1000 in Berkshire back then, your portfolio would have grown to over $24 million by 2017, whereas investing the same amount in the S&P 500 would have yielded only $155,000. This exemplifies the compounding magic that comes with investing in a solid company for the long term.

Some of the investors I met at the recent Berkshire AGM shared with me that they have held onto Berkshire Class A stock for over 20 years. Back then, Berkshire A was priced at around $30,000 per share, and today it has reached nearly $500,000.

For the complete breakdown of Berkshire’s portfolio, you can find out here.

Berkshire Hathaway Stocks — When To Buy?

Now that we understand Berkshire is a highly diversified company led by an exceptional management team, the next question arises: when is the right time to buy?

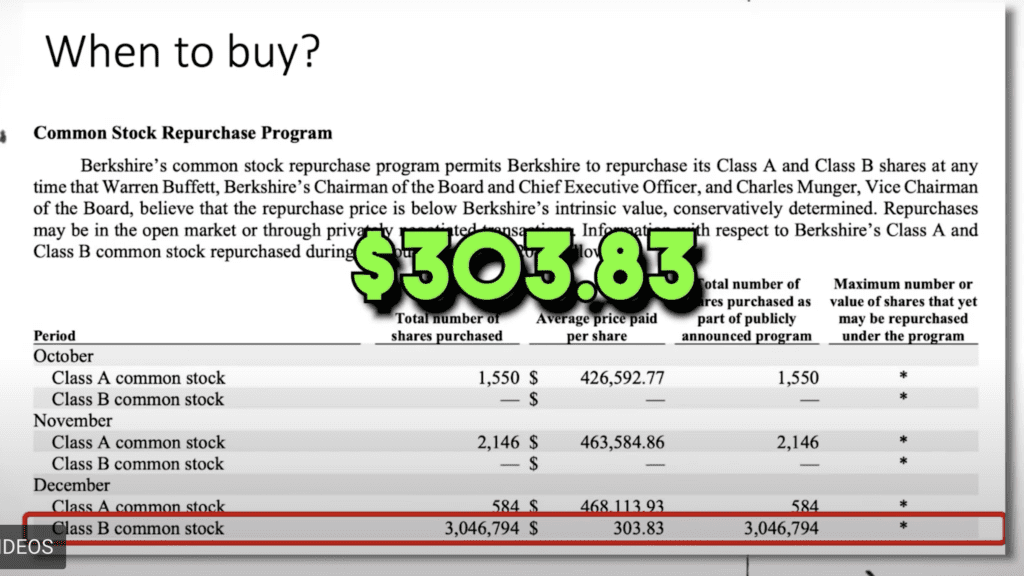

By examining their annual report, you can discover the exact price at which the company repurchased its shares, which was $303.83. This indicates that Warren Buffett believes Berkshire is undervalued at $303, prompting the approval of share buybacks at that price.

So how can we use options to capitalize on this knowledge? Then make sure you check out my video below to understand how to use B.O.S.S options strategies to your advantage! Using this strategy, you can collect a few hundreds dollars of passive income while promising to own Berkshire Hathaway’s stocks. Watch my video below to find out how.

In the meantime, feel free to join my Telegram channel for daily investment updates. Do check out my latest article on how to analyse any stock in 1 minute using this amazing free AI investing tool.