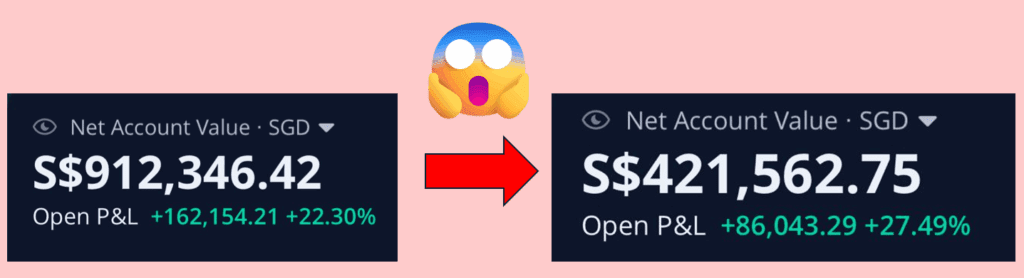

My Webull account went from over $900,000 to only $400,000 left.

WHAT HAPPENED?

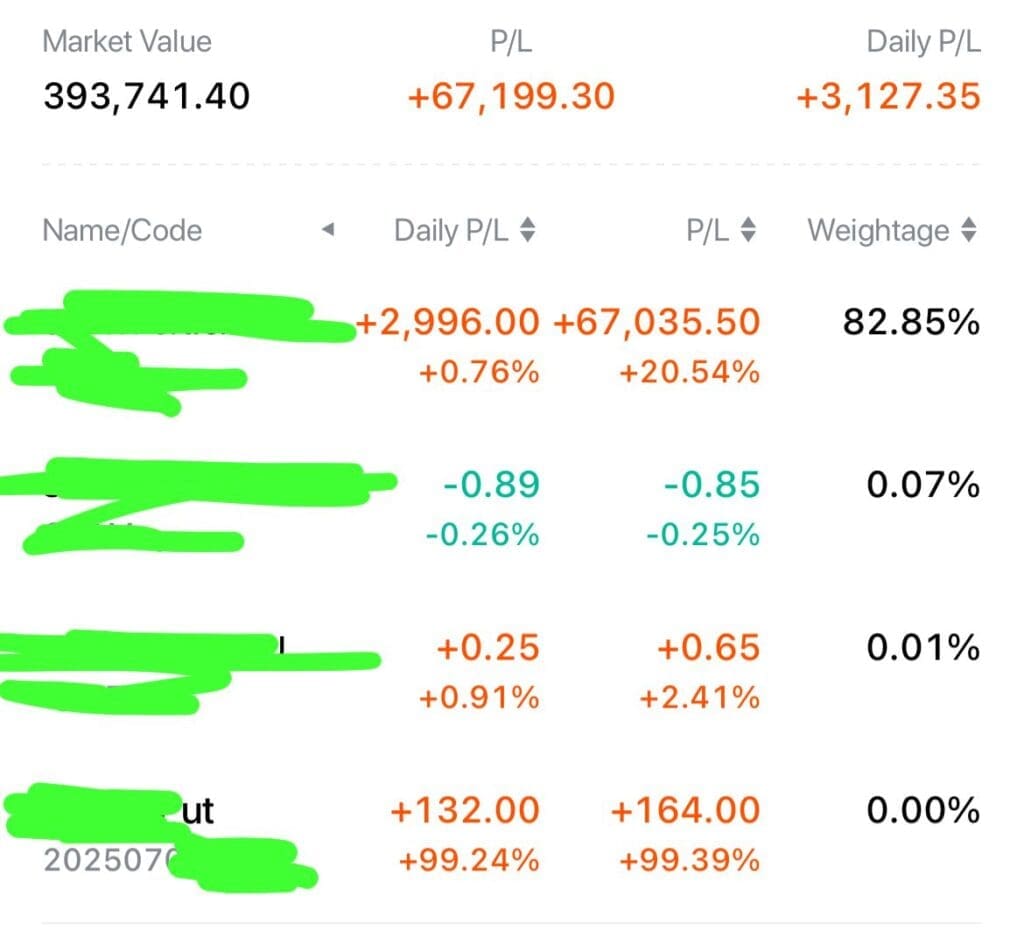

Before you panic—don’t worry, I didn’t blow up my portfolio with risky trades. In fact, my portfolio has been growing stronger than ever with my ETF and options strategy. But when I logged in the other day…

Simple—I transferred over $400,000 worth of shares to Longbridge.

Why?

✅ To diversify my brokerage risk. Many investors don’t realise that while your stocks are generally safe, there’s a limit to brokerage protection. SIPC (Securities Investor Protection Corporation) only covers you up to $500,000 per account, including $250,000 for cash. If your broker ever fails, anything beyond that isn’t protected.

✅ Plus, I couldn’t resist the free iPhone 16 Pro Max that Longbridge was offering last month for transferring over $200K worth of shares (I made a video about it before).

But if you’re new to investing and wondering which brokerage is better for you, here’s my honest comparison after using both platforms:

Webull vs Longbridge — Which is Right for You?

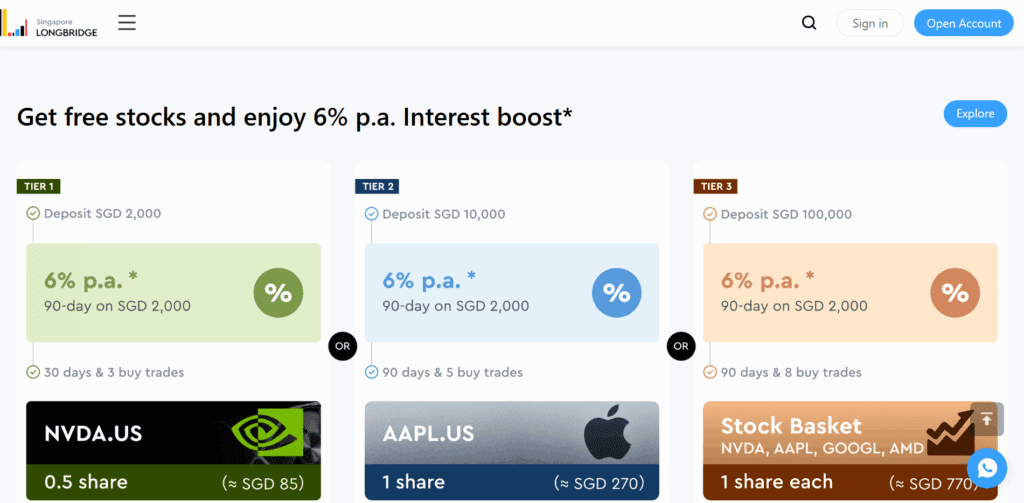

1️⃣ If you want the best account opening perks → Longbridge

- Longbridge offers free shares like Apple, Nvidia, Google, and AMD worth up to SGD $770, based on your deposit.

- Webull gives fewer free shares, but offers trading vouchers to offset your commission fees.

2️⃣ If you prefer hassle-free rewards → Webull

- With Webull, just fund your account and hold your funds to qualify for rewards. No buy trades required.

- Longbridge’s rewards are more attractive but come with conditions: at least 8 buy trades and holding funds for 90 days.

Pro tip: Buying 0.001 share of SPY counts as a trade—so 8 trades can cost you under $5 total, for up to $770 in free shares.

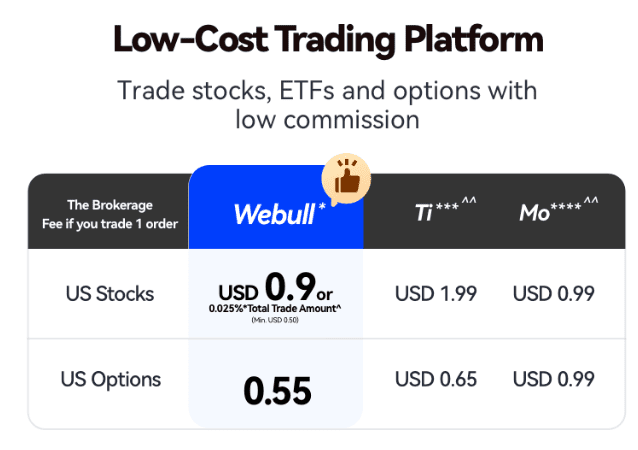

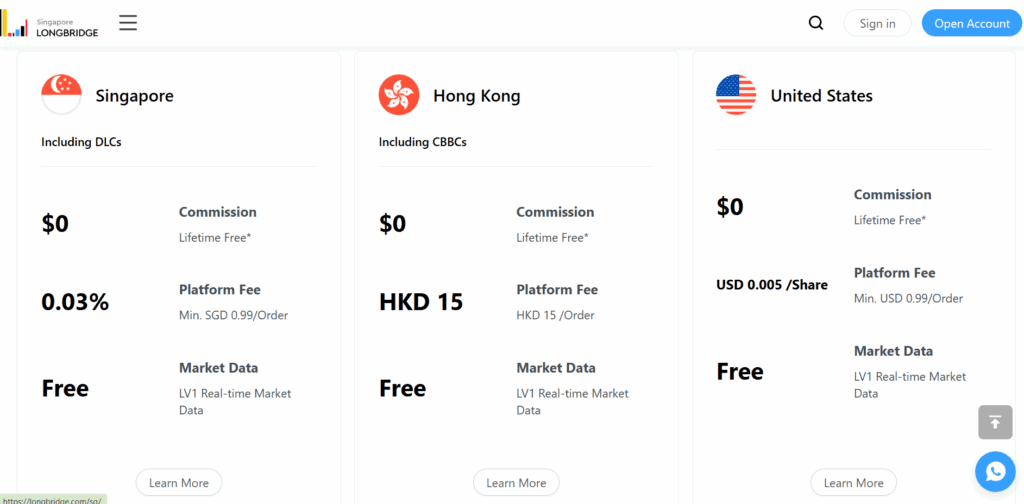

3️⃣ If you want to save on long-term commissions → Webull

- Webull offers the lowest fees in town for stocks, ETFs, and options, with zero platform fees (at least for now).

- Longbridge, similar to Moomoo and Tiger, charges platform fees that can add up over time.

4️⃣ If you care about sleek, user-friendly design → Both are good, but here’s the difference:

- Webull’s app has a more familiar, Western-style interface.

- Longbridge is easy to use too, but be prepared—the colour coding is the opposite of what many are used to. In Longbridge, red means profits, and green means losses. That’s how many Chinese investors view it—they love seeing a sea of red inside their portfolio, which is exactly what’s happening to my Longbridge account right now… but in a good way! 😉

So, which one is for you?

✔️ If you want to maximise new account perks and don’t mind a few easy trades → Longbridge

✔️ If you prefer simple execution and long-term cost saving → Webull

✔️ If you have over $500K invested → Consider splitting between platforms for brokerage diversification (like I did!)

The most important thing is to start, stay consistent, and grow your wealth safely the Arigato way!

Feeling lost on how to start investing, especially during these uncertain, war-driven times?

I just ran a live workshop teaching exactly how to invest safely during war time—including the 3 key sectors I’m watching right now.

You can catch the full replay here:

👉 World War 3: How To Invest During War Time

Meanwhile, if you’d love to learn the exact method I used to grow my million-dollar portfolio—by combining options with ETF investing safely—you’re welcome to join my free 2-hour Options To Freedom masterclass here!