Yes, you read that right.

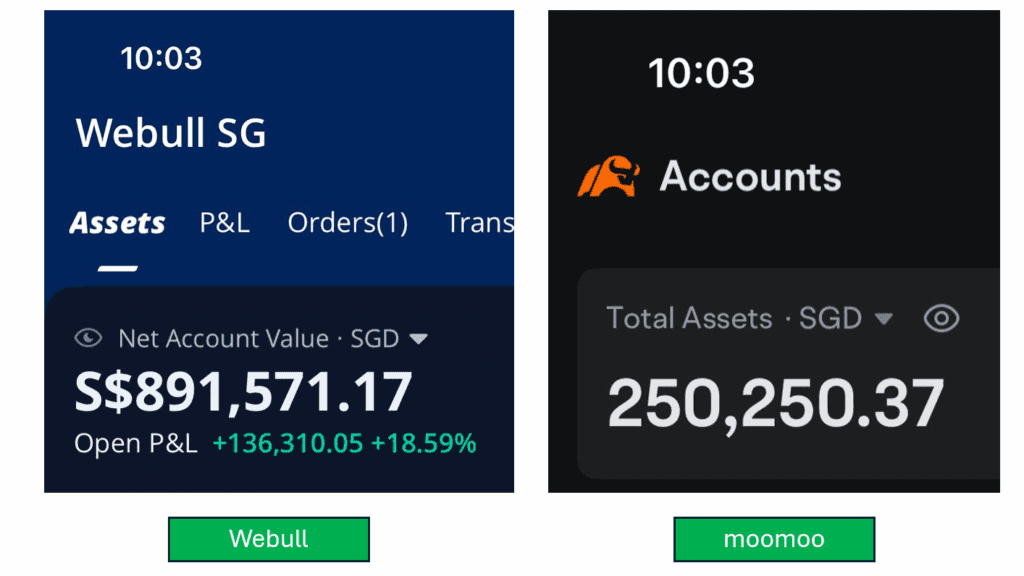

Even though I already have close to $900K SGD in Webull and another $250K+ SGD in Moomoo, investing in stocks and options. I’m now seriously considering parking another six-figure sum into a third brokerage account.

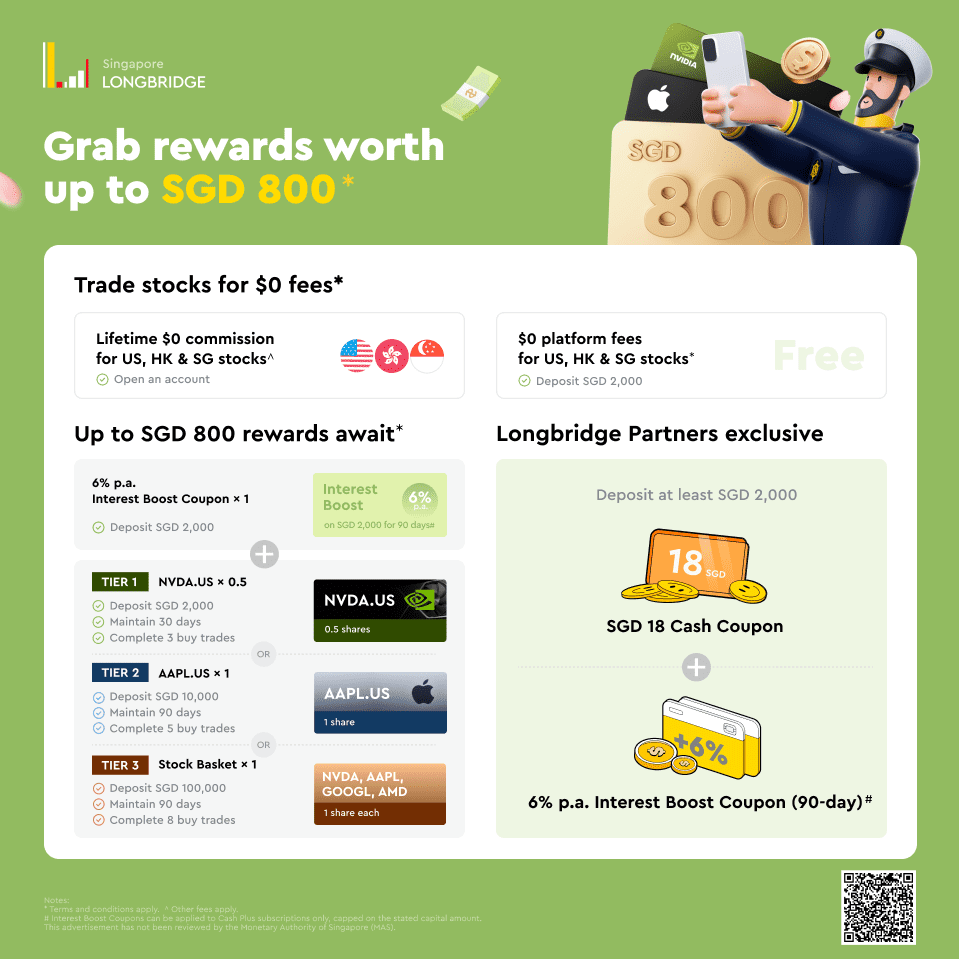

Why? Because I recently came across Longbridge Singapore, and their rewards and platform benefits are probably the best I’ve seen in a long time.

When a new brokerage enters the market, they often roll out crazy good deals to attract users—and Longbridge is doing just that. But beyond the attractive perks, there’s actually a very solid case for using them long-term.

Let me break it down for you.

💡 Why Longbridge Is Worth a Look

✅ Lifetime $0 commission on US, HK & SG stocks

✅ $0 platform fees for your first 100 trades per market, every month

(For new users only, valid until 31 July 2025. T&Cs apply)

It essentially means that you can invest/trade for free for these two months, to unlock all these amazing rewards below:

🎁 And the Free Stocks? Pretty Generous:

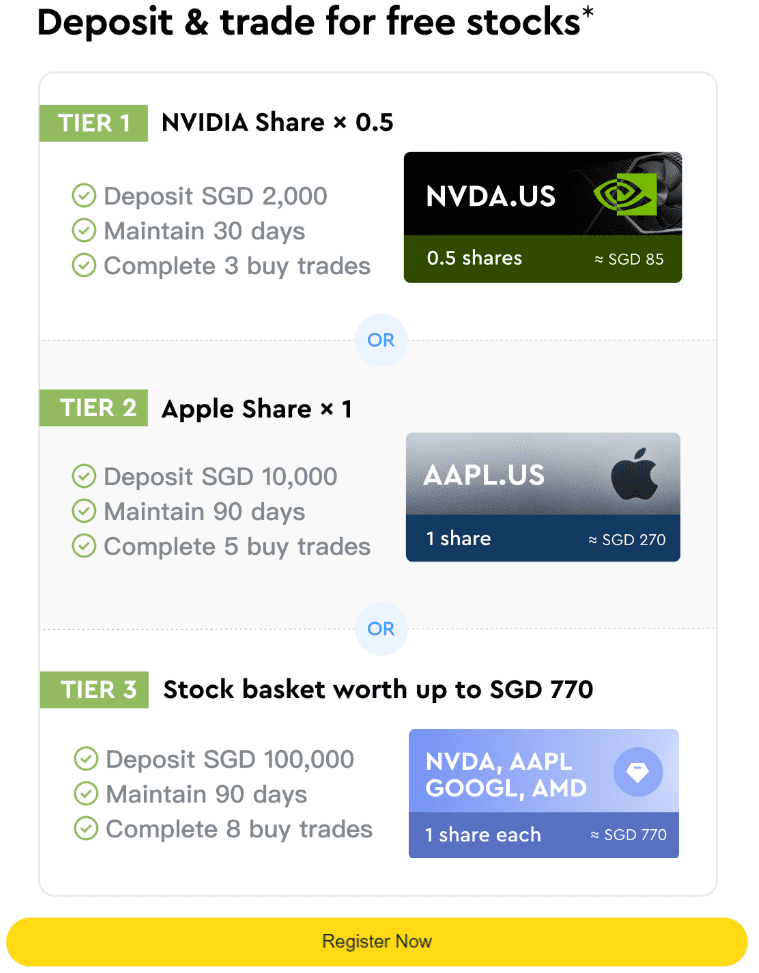

📈 Maintain SGD $2,000 for 30 days + 3 buy trades → Get 0.5 Nvidia stock

💻 Maintain SGD $10,000 for 90 days + 5 buy trades → Get 1 Apple stock

🌐 Maintain SGD $100,000 for 90 days + 8 buy trades → Get 4 big tech stocks:

Nvidia, Apple, Google, and AMD

Honestly, these stock rewards alone make it a compelling reason to park your funds there. I’m personally gunning for tier 3 so I can earn FREE $770 SGD worth of shares!

🔥 But What Really Caught My Eye?

The 12% interest boost. 🤯

If you sign up through my exclusive invite link, you’ll receive an extra 6% interest boost, on top of Longbridge’s standard 6%—giving you a total of 12% interest boost for 90 days, applicable on your first SGD $2,000 deposit.

That’s essentially getting your cash to work for you before even making your first trade.

🛡️ Is It Safe?

Yes. Longbridge is regulated by the Monetary Authority of Singapore (MAS) and offers SIPC protection of up to USD $500,000 for your securities—just like other major platforms.

For me, it also serves a practical purpose: diversifying brokerage risk.

SIPC only protects up to USD $500,000 per brokerage, so spreading out my portfolio across trusted platforms makes complete sense.

🌱 Thinking of Trying It?

If you’ve been waiting for the right opportunity to get started with investing, or just want to diversify your brokerage like I do, this might be the moment.

👉 Sign up here to claim your 12% interest boost and free stocks:

https://rebrand.ly/longbridge

💭 A Quick Reflection…

The reason I’ve grown my portfolio to over a million dollars wasn’t luck—it was consistency, proper strategy, and staying invested for over 10 years, which then resulted in $136,000 profits in 1 year just from my webull account alone.

I didn’t need to stare at the market all day. I found a peaceful, long-term approach that worked—and I believe others can too.

If you want to learn how to grow your wealth safely and peacefully, without stress or constant market monitoring, I invite you to my upcoming 2-hour Options to Freedom Masterclass.

It’s a great starting point if you’re ready to build long-term wealth, the calm and steady way.

💬 What About You?

Have you tried Longbridge yet?

What platforms are you using to manage brokerage risk or earn better returns?

Drop a comment below—I’d love to hear what’s working for you.

I have only tried Webull and IBKR for the purpose of selling options. My preference is IBKR, as it offers favorable margin requirements and pays significant interest on idle funds—which is important for an options seller, since you often have a substantial cash balance in your account.

As for Webull, I may have missed some features, but I was only able to sell cash-secured puts. This limitation restricts the range of option strategies and money management approaches I can use. I am not sure if Longbridge has similar limitations?

You are right, IBKR offers the most flexibility in options, while Webull does have its restriction like cash-secured puts. According to my research, Longbridge offers more flexibility than Webull and allows naked put, as long as the margin allows. But I don’t advise my students to do that as it will also incurr unnecessary risks.